The smart Trick of Business Owners Policy - First Tech Insurance Services That Nobody is Talking About

The Business Owners Policy Insurance Coverage Guide - Clovered Ideas

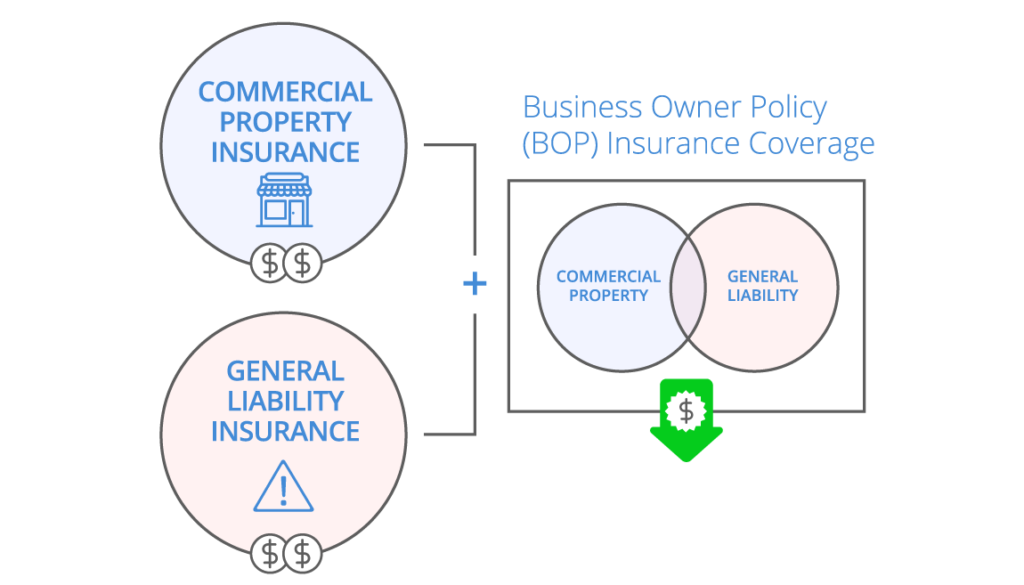

A BOP generally secures company owner versus property damage, hazard, organization interruption, and liability. While protections vary among insurance coverage service providers, organizations can typically opt-in for additional coverage, such as crime, spoilage of product, forgery, fidelity, and more. Insurance providers identify if a business receives a BOP based on organization place, the size of the location, the class of business, and revenue.

What is Independent Contractor Insurance? - Small Business Insurance, Simplified

What (Really) Goes Into Business Owners Policy That Works

Understanding Entrepreneur Policies An entrepreneur's policy provides several insurance items rolled into one, normally targeted to little- and mid-size companies. Company owner insurance usually consists of home, business disturbance, and liability insurance coverage. Yet, most policies need businesses to satisfy particular eligibility criteria to qualify. This Is Cool or commercial property insurance portion of a BOP is generally offered as named-peril coverage, which provides protection only for damage brought on by events particularly noted in the policy (normally fire, explosion, wind damage, vandalism, smoke damage, etc).

Characteristics covered by a BOP usually include structures (owned or rented, additions or additions in progress and outdoor components). The BOP will also cover any business-owned products or items owned by a 3rd celebration but kept momentarily in the care, custody or control of business or entrepreneur. Business home need to generally be kept or kept in qualifying proximity of company premises (such as within 100 feet of the premises).

Should You Get Business Owners Policy Insurance? - Small Business Trends

It can likewise consist of the additional cost of operating out of a temporary place. BOPs with liability protection will have the insurer cover the insured's legal duty for damages it may inflict on others. This damage would have to be an outcome of things done in the normal course of organization operations, which may cause bodily injury or property damage due to malfunctioning products, defective setups and mistakes in offered services.

An Unbiased View of All You Need to Know about a Business Owners Policy

Small Company Administration (SBA) suggests performing a danger assessment before buying a BOP to notify the organization owner's decision when choosing a level of coverage. Unique Considerations An entrepreneur policy might also consist of crime insurance coverage, automobile protection, and flood insurance coverage. Depending upon a company' private scenario, business owner and the insurance provider may make plans for additional protection parts.